Figma’s IPO: A New Dawn for Startups in the Tech Sphere

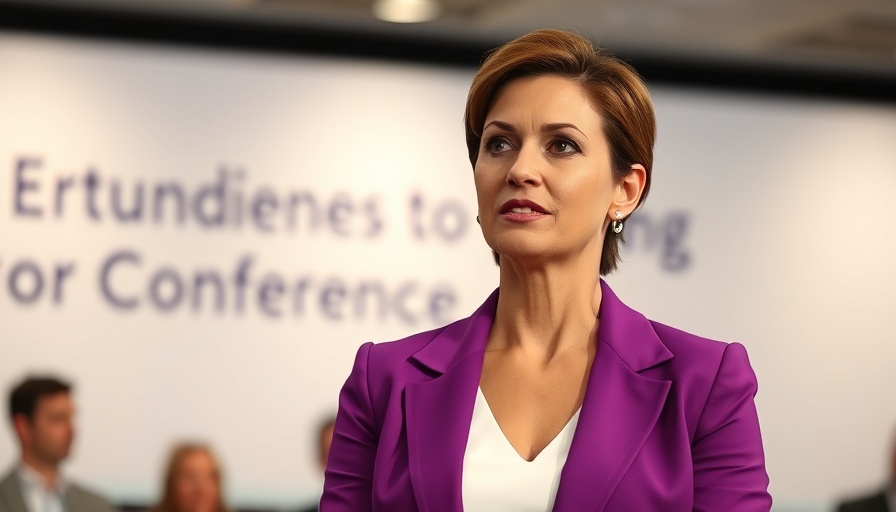

The recent triumph of Figma’s IPO has ignited significant discourse within the tech community, drawing attention to the vital role of regulatory scrutiny in mergers and acquisitions. Lina Khan, the former chair of the Federal Trade Commission (FTC), has positioned herself at the epicenter of this conversation. Through a recent post on X, Khan extolled the Figma IPO as a quintessential example of how supporting startups can lead to monumental value creation, challenging the prevailing narrative that stringent regulatory oversight stifles innovation.

Unpacking the Fallout from Adobe's Failed Acquisition

Figma's road to its IPO was fraught with hurdles, notably Adobe's attempt to acquire it for $20 billion in 2023—an effort ultimately derailed by rising regulatory concerns. Regulatory bodies like the European Commission and the U.K. Competition and Markets Authority expressed trepidation over the potential dampening of Figma’s competitive edge. Khan’s resistance to such acquisitions illuminated her commitment to fostering an environment where startups can grow independently and spur innovation across the sector.

The Diverging Narratives: Champions vs. Critics

Khan’s endorsement of Figma intertwines with broader themes in the tech landscape. While she heralds the IPO as a testament to her FTC tenure, detractors assert that Figma's success is more attributed to its unique innovation than any specific regulatory intervention. For instance, Dan Ives of Wedbush Securities remarked, "Figma's growth is a testament to its innovative strategies more than the influence of the FTC or Khan's policies.” This dichotomy underscores the ongoing debate around the impact of regulatory environments on entrepreneurship.

Regulatory Landscape: The Future of Mergers and Acquisitions

Khan's tenure reflects a palpable shift towards heightened regulatory scrutiny concerning Big Tech’s acquisition strategies. By advocating for limitations on market consolidation, she posits that a more competitive ecosystem will emerge, wherein numerous players can enter the arena. This dynamic is crucial for startups seeking funding opportunities, as it cultivates an environment ripe for innovation, allowing the entrepreneurial spirit to soar unimpeded.

The Endless Conversation on Innovation and Market Competition

As Figma’s success story continues to unfold, the dialogue surrounding regulatory practices escalates in importance. The premise that a vibrant competitive landscape yields enhanced innovation is vigorously supported by those who advocate for Khan’s policies. However, the paradox remains: do stringent regulations deter essential investments that drive growth? This question invites continuous exploration as industries adapt and evolve.

Future Predictions: Anticipating Trends in the Tech Ecosystem

Looking ahead, the implications of Figma's IPO could signal dramatic changes in the future of mergers and acquisitions, especially within sectors dominated by a handful of players. Should Khan's philosophy on competition gain traction, an era may emerge where startups retain greater agency, potentially leading to an explosion of innovation as they forge their growth trajectories under their terms rather than being subsumed by larger entities.

Conclusion: Charting a New Course in the Tech Horizon

The Figma IPO serves as an illuminating case study on the complex interplay of regulation and entrepreneurship within the tech ecosystem. It compels ongoing discussions about how best to navigate this intricate landscape. As we reflect on Figma's journey and Khan’s regulatory philosophy, the broader implications for business leaders, CTOs, and entrepreneurs become clear. Adapting to these shifts is not just necessary—it is essential for maintaining relevance in an ever-evolving marketplace.

Add Row

Add Row  Add

Add

Write A Comment