Revolutionizing Fantasy Sports: The Investment Behind Fantasy Life

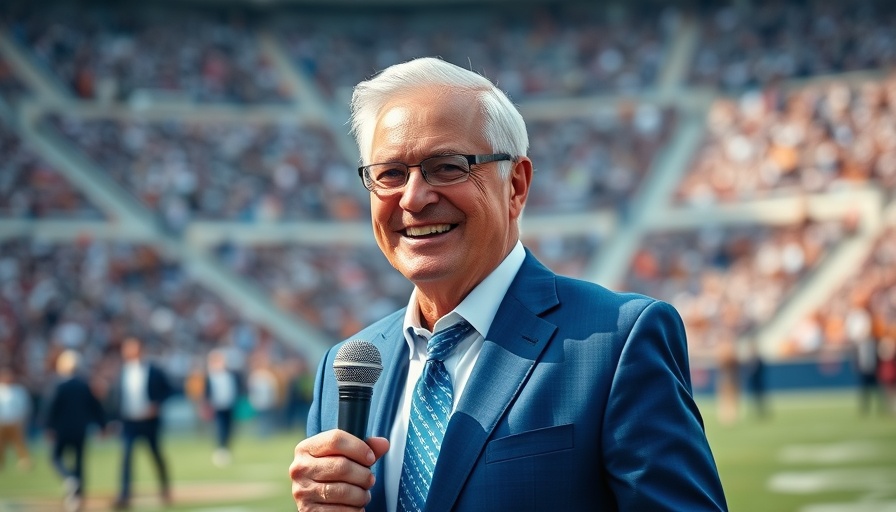

Matthew Berry, a notable NBC Sports analyst and a prolific figure in the fantasy sports arena, has successfully raised $7 million for his startup, Fantasy Life. This funding round, bolstered by prominent investors such as LeBron James and Maverick Carter of LRMR Ventures, marks a significant milestone in Berry's vision of creating a comprehensive platform for fantasy sports enthusiasts.

Berry describes Fantasy Life as a "one-stop shop" for all levels of fantasy sports participants, whether they are seasoned players or beginners seeking guidance. The evolution of Fantasy Life from a book to a thriving media company illustrates the growing interest and potential within the fantasy sports market.

Fantasy Life's vision aligns perfectly with the surge in popularity of fantasy sports, which not only generates engagement among fans but also connects diverse demographics—from novices to seasoned pros in the realm of sports.

The Strategic Growth Journey of Fantasy Life

Berry initially ventured into the fantasy sports landscape with his bestselling book, Fantasy Life, which became the bedrock for his subsequent endeavors. Leveraging his insights, he transitioned his book into a newsletter and subsequently expanded into a comprehensive media company. This strategic pivot was crucial, as it allowed Fantasy Life to create a robust platform where fans could access not only analysis and guidance but also community engagement through tools such as Guillotine Leagues—a novel approach to fantasy football that heightens competition and interactivity among players.

The company’s growth exemplifies how innovating a traditional format can attract investment and foster community. As Austin Rief, a key advisor and co-founder of Morning Brew, highlighted, Berry's potential in the fantasy sports sector was underestimated initially, yet his numbers surged, affirming the demand for such a platform.

Guillotine Leagues: A Game-Changer in Fantasy Sports

One of Fantasy Life’s standout acquisitions is Guillotine Leagues, a format that twists conventional fantasy league play by eliminating players after a loss. This distinctive approach not only retains player interest longer but also intensifies competition, thus offering a fresh experience for enthusiasts. Berry's ambitious plans for this league reflect a keen understanding of market demands, as it caters to both casual players and competitive gamers.

Valuation Insights: What Investors Are Looking For

As Fantasy Life positions itself for further growth, understanding investor expectations becomes paramount. Investors today seek startups demonstrating not only compelling product-market fit but also robust revenue models. In the case of Fantasy Life, its diverse offerings—from betting analysis to community engagement—exemplify a multifaceted revenue strategy that can sustain long-term growth.

The Future of Fantasy Life and Its Impact on Small Business Growth

As Berry forges ahead with Fantasy Life, the future seems ripe with opportunities, especially in an era where digital engagement and personalized content are crucial for user retention. This journey also reflects broader implications for small businesses navigating the tumultuous waters of funding and scalability. By understanding how platforms like Fantasy Life adeptly capture capital and cater to diverse needs, different businesses can glean insights into growth equity and operational efficiency that could fuel their own success.

Call to Action: Maximizing Your Business Growth Capital

For entrepreneurs and business leaders seeking to optimize their capital structure, it's vital to consider how to balance debt and equity funding. Resources like Fantasy Life showcase the importance of aligning investor expectations with business strategy. If you are a founder looking to scale, consider how you can implement insights from successful scale-ups to optimize your own journey toward growth. Whether it's preparing for an IPO or exploring alternative funding methods, understanding the market landscape and leveraging growth capital strategically will be paramount as you chart your path forward.

Add Row

Add Row  Add

Add

Write A Comment