Record Highs in Middle East Investment: A Game Changer for MENA Startups

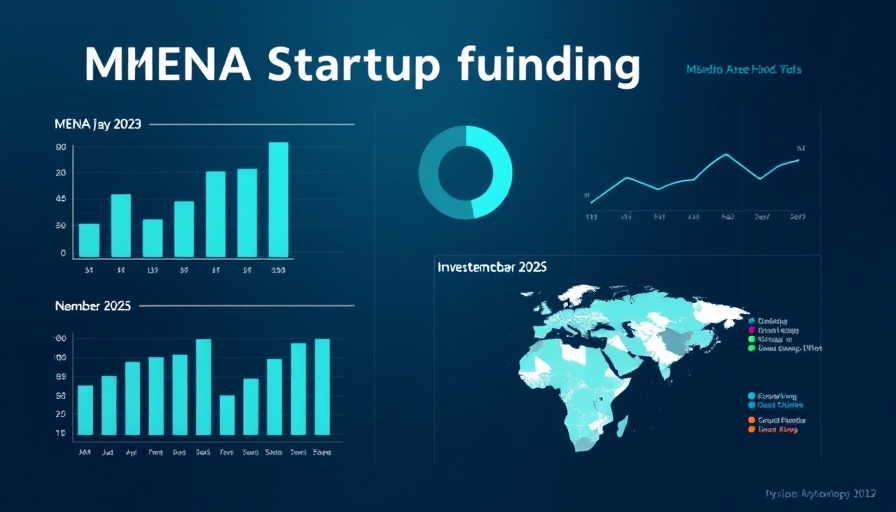

September 2025 marked a transformative moment for the Middle Eastern and North African (MENA) startup ecosystem, with funding soaring to a stunning $3.5 billion in just one month. This exceptional milestone comes on the heels of a Q3 total of $4.5 billion raised across 180 deals, reflecting a remarkable 523% quarter-on-quarter jump and signaling an unprecedented revival of investor interest. Much of this momentum can be attributed to Saudi Arabia, which firmly dominated the funding landscape by securing approximately $2.7 billion across 25 startups.

Saudi Arabia's Dominance: Factors Behind the Surge

The financial resurgence in MENA is heavily driven by mega-deals particularly in the fintech sector. Leading the charge was Tamara, which alone accounted for a significant $2.4 billion in debt funding. Other substantial rounds included Hala's $157 million Series B and Lendo's $50 million debt funding, showcasing a trend towards larger financing rounds—a stark contrast to the more fragmented investments seen in previous months. Up and coming fintechs are clearly capitalizing on a burgeoning growth environment, given the heightened investor confidence in the region, bolstered by significant events like Money20/20.

Broad Sectoral Trends and Opportunities

While the fintech sector remains dominant, with around $2.8 billion allocated to 25 deals, the landscape is diversifying. Proptech emerged as a strong contender with Property Finder alone raising $525 million. Furthermore, early-stage startups continue to draw significant investor interest, with 55 young companies attracting $129.4 million despite mature ventures securing larger sums. This shift points to an evolving investment strategy, aligning with a broader trend towards hybrid business models that optimize monetization efforts across consumer and enterprise domains.

Gender Disparity in Startup Funding: An Ongoing Challenge

Despite the surge in capital, a concerning trend persists: the stark gender funding gap. Male-founded entities captured 94% of the funding pie, while their female counterparts garnered a mere $1.1 million. This underlines the urgent need for a systemic change that fosters inclusivity and diversity within the MENA startup scene. As the landscape evolves, addressing this imbalance could amplify innovation and drive sustainable growth.

Looking Ahead: What This Means for Future Investments

With year-to-date funding standing at $6.6 billion, the trajectory suggests that 2025 could set an all-time funding record for MENA startups. Investors are increasingly attracted to regions showcasing resilience and growth potential amid global economic headwinds. As mentioned in various expert insights, the combination of strategic alignment, improved infrastructure, and an expanding talent pool creates an opportune environment for investment.

As we progress through the rest of the year, it's critical for stakeholders to closely analyze emerging trends within the MENA region, not only in terms of financing but also with a focus on refining business models and addressing the existing disparities. Sustainability and inclusivity will play pivotal roles in shaping the region's startup narrative for the years to come.

For investors and business leaders keen on navigating this vibrant landscape, a proactive approach will be essential. Engage in networks, seek partnerships, and invest in innovative models that speak to evolving consumer demands, as these will be crucial for capitalizing on growth opportunities in the months and years ahead.

Add Row

Add Row  Add Element

Add Element

Write A Comment