The Surprising SPAC Deal: A Closer Look at iRocket's Acquisition

The landscape of special purpose acquisition companies (SPACs) is filled with both challenges and surprises. One of the newest cases is BPGC Acquisition Corp.'s intent to acquire Innovative Rocket Technologies Inc. (iRocket) for an ambitious $400 million, a deal puzzling given the SPAC's recent financial struggles. Even as public markets show signs of life, this situation serves as a reminder that not all paths to public company status are straightforward.

Financial Challenges Looming Over the SPAC

BPGC Acquisition Corp., headed by former Commerce Secretary Wilbur Ross, has seen its trust fund deplete significantly since its IPO in March 2021, which raised $345 million. By September 2024, the SPAC had returned much of its cash to shareholders, leaving only $30.5 million in trust. The recent development to extend the acquisition deadline to March 2026 is revealing of the SPAC's internal struggles and the rarity of effective capital management amid wavering investor confidence. With the company reportedly left with only $1.6 million at one point, the uphill battle for both BPGC and iRocket becomes increasingly pronounced.

iRocket: A Startup at a Crossroads

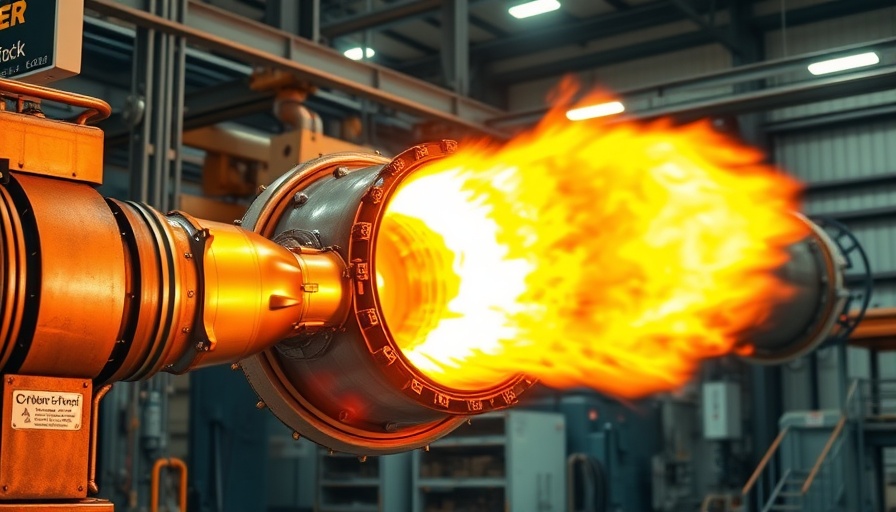

Founded in 2018, iRocket has struggled to make a significant leap within the highly competitive small launch vehicle market, where achieving successful test flights is paramount. Despite early backing by Village Global—a venture capital firm that boasts ties to ultra-wealthy partners like Bill Gates—iRocket's limited funding and lack of operational milestones significantly undermine its attractiveness as a public offering.

This backdrop raises critical questions surrounding the startup's viability in an increasingly crowded marketplace. Competitors like Firefly and Stoke Space have been actively developing their hardware, putting iRocket's $400 million valuation into question. In this climate, as iRocket aims for its Shockwave launch vehicle to prove itself, the stakes are high, and time is of the essence.

Understanding the Market Landscape

The trajectory of small launch startups has continuously evolved, aligning with broader trends in the aerospace sector. The demand for small satellites and low-cost transportation to orbit has led many companies to refine their technologies and operations. However, the financial metrics associated with going public—especially for capital-intensive industries like space technology—represent substantial hurdles that could deter even seasoned investors. Analyzing how firms position themselves against established benchmarks is essential for understanding where the market is heading.

Implications of Public Market Transition

For firms like iRocket, the push toward a public offering necessitates a thorough review of operational readiness. Essential aspects include achieving investor-grade financials and developing a solid roadmap to operational efficiency. The public markets seek companies that exhibit sustainability in long-term profitability. Therefore, founder operators in space tech must not only focus on rigorous launch schedules but also adopt strategic frameworks that align with the financial expectations of institutional investors.

Conclusion: Navigating the Path Forward

As iRocket and BPGC navigate this complicated SPAC acquisition, the lessons extend beyond the immediate financial implications. Smaller firms looking to transition to a public setup must recognize the complexities and prepare accordingly. The focus should remain on operational excellence and capital structure optimization, as these elements are critical to attracting growth equity for small businesses in competitive markets.

For executives and founders in similar situations, it's imperative to look toward strategies that enhance your operational framework, focusing on profit roots and investor attractiveness. The lessons learned from this deal can serve as a blueprint for future market entrants, emphasizing preparedness and a thorough understanding of how to make your firm valuable in both private and public realms.

Add Row

Add Row  Add Element

Add Element

Write A Comment